In today’s business environment, financial management isn’t optional—it’s a daily reality for every company. But for most SMEs in Singapore, the existing options usually come down to two less-than-ideal choices:

You can choose a “DIY” SaaS tool like QuickBooks, Xero, Booke AI. These tools can be powerful, but they assume you (or your team) understand accounting, and they require you to set up, maintain, and review complex workflows. For many Singapore SME owners, that’s not realistic—they don’t want to deal with complicated software, risk making errors, or pay for a full-time finance team they can’t afford.

The other option is hiring a traditional accounting firm to handle everything for you. But that often means slower communication, manual processes, higher costs, and less real-time visibility for owners.

This is exactly why so many SME owners choose to outsource accounting:

They don’t have accounting knowledge

It’s too much hassle

They want answers on demand

Hiring in-house is too expensive

ccMonet offers a third choice: an AI-powered hybrid SaaS platform designed specifically for Singapore’s SMEs and accounting firms. It combines intelligent automation with professional review and real expert support to deliver Simple. Smart. Reliable. Accounting, so you can focus on growing your business, not managing paperwork. In this post, we'll compare ccMonet vs. Zeni AI across features, user experience, interface design, target audience, and pricing to help you find the right fit for your business.

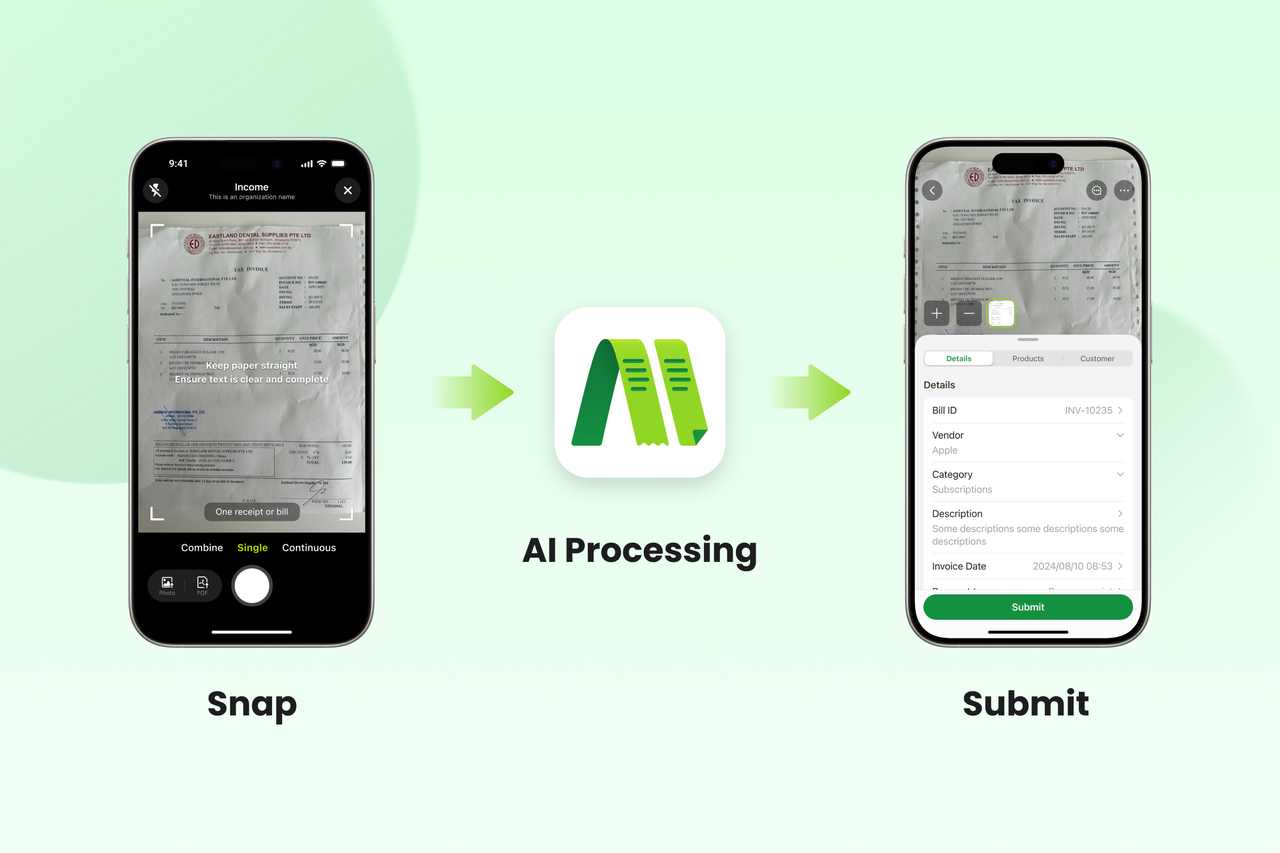

Simple: Just snap and upload receipts with your phone. Any staff member can do it—no training required.

Smart: Advanced AI reads multi-language and even handwritten invoices, automatically categorises expenses, reconciles daily with your bank, and streamlines expense claims. Real-time reporting helps business owners make faster decisions and supports industry-specific workflows for F&B, logistics, clinics, and more.

Reliable: Every transaction is reviewed by certified accountants to ensure compliance and accuracy. With real expert support, you always have someone ready to help.

Full Service Scope: Our platform provides one-stop services covering bookkeeping, reconciliation, expense management, tax compliance, and corporate secretarial support, all designed for Singapore’s multi-currency, multi-language environment.

Zeni AI:

AI-powered bookkeeping platform with dedicated finance team

Automates expense categorisation, bank reconciliation, and transaction matching

Centralised dashboard with real-time P&L, balance sheet, cash flow, and KPIs

Bill payments, reimbursements, and corporate credit card management included

Personalized budgeting recommendations and financial advisory

Business checking accounts with high-yield interest and no monthly fees

But:

Requires you to integrate your bank and business accounts

Designed for businesses ready to manage payments, banking, and credit in one platform

Best suited for companies with growth-stage funding or more complex financial operations

Why does this matter?

Zeni AI is a highly capable, all-in-one financial operations platform—but you’re still responsible for connecting accounts, managing cash flow, and using the tools correctly. ccMonet is outcomes-as-a-service: you just snap a photo, and our AI plus expert team handles everything else. It’s perfect for busy Singapore SME owners who want to reduce hassle, save time, and stay compliant—without needing in-house finance staff.

Many local SMEs don’t have the time or staff to manage their payments, reconciliations, and reporting daily in a single platform. ccMonet offers a completely hands-off approach, even for businesses with no dedicated finance team.

ccMonet: Truly Designed for Everyone

Ultra-simple, mobile-first interface so anyone—drivers, waiters, admin staff—can instantly snap and upload receipts

AI automatically handles 80–90% of categorisation, reconciliation, and data entry

Certified accountants ensure 100% accurate, compliant records

Real-time dashboards with clear insights

Real expert support built in

Core Experience: Frontline staff snap → AI processes → Experts review → Business owner views real-time reports

Zeni AI: Designed for Integrated Financial Management

User connects multiple bank and credit accounts

AI automates transaction categorisation, bill payments, and reimbursements

Central dashboard offers advanced financial insights and recommendations

Best for teams ready to use bill pay, banking, cards, and bookkeeping in one place

Core Experience: Owner/staff uploads or connects data → AI categorises → User reviews dashboards → Manages payments and cash flow

For many Singapore SMEs, this difference is critical. Zeni’s comprehensive features work well if you want an all-in-one finance hub—but can feel complex if you just want your bookkeeping done for you. ccMonet was built so any employee can use it instantly, making it ideal for lean teams with no dedicated finance expertise.

ccMonet:

Mobile-first, “snap and go” design

Clean, easy-to-use interface for busy frontline staff

Automated delivery of expert-reviewed, accurate financial results

Owner dashboards with clear, visual reports—even for non-accountants

Zeni AI:

Web-based unified dashboard with charts, KPIs, and real-time financial data

Includes bill pay, reimbursements, banking, and credit card management

Requires setup to connect all financial accounts

Offers advanced planning, audit, and monitoring features

Many small business owners in Singapore want accounting software that works immediately without lengthy setup. Zeni AI offers more control for companies willing to manage all payments and accounts in one place. ccMonet is designed for effortless simplicity, so staff can capture receipts on the go and owners get clear, real-time reports with zero complexity.

ccMonet Advantages:

Simple: Extremely low barrier to entry—any employee can use it with no training

Smart: AI automates the majority of the work

Reliable: Certified accountants ensure accuracy and compliance

All-in-one: Bookkeeping, reconciliation, expense claims, tax, corporate secretarial services

Real expert support: Always someone available to help

Zeni AI:

Advanced automation but requires integration and setup

Best for businesses that want payments, credit, and banking in one platform

Rich dashboards require users to understand financial KPIs

Designed for companies with dedicated finance staff or financial advisors

For many Singapore SMEs, the biggest challenge isn’t just data entry—it’s knowing what to do when things get complicated. Zeni AI’s advanced features are great for finance-savvy teams. ccMonet includes expert human support built in, so you’re never stuck without answers—even if you have no in-house finance staff.

Who is ccMonet for?

SME owners without an accounting background who want peace of mind

Frontline staff who need a simple way to submit receipts

Accounting firms serving multiple SMEs

Industries with complex, multi-language, multi-currency needs like F&B, clinics, logistics, auto workshops

Who is Zeni AI for?

Startups and growth-stage companies looking for advanced financial insights

Businesses with multiple funding rounds that need tailored financial planning

Companies wanting integrated bill pay, reimbursements, banking, and credit in one platform

For many local SMEs, the question is simple: do you want to manage a sophisticated financial hub in-house? If so, Zeni AI offers deep control and automation. But if you want true hands-off, AI-powered bookkeeping with human review, ccMonet is built for you. It’s purpose-designed for Singapore SME needs—not just a generic global solution.

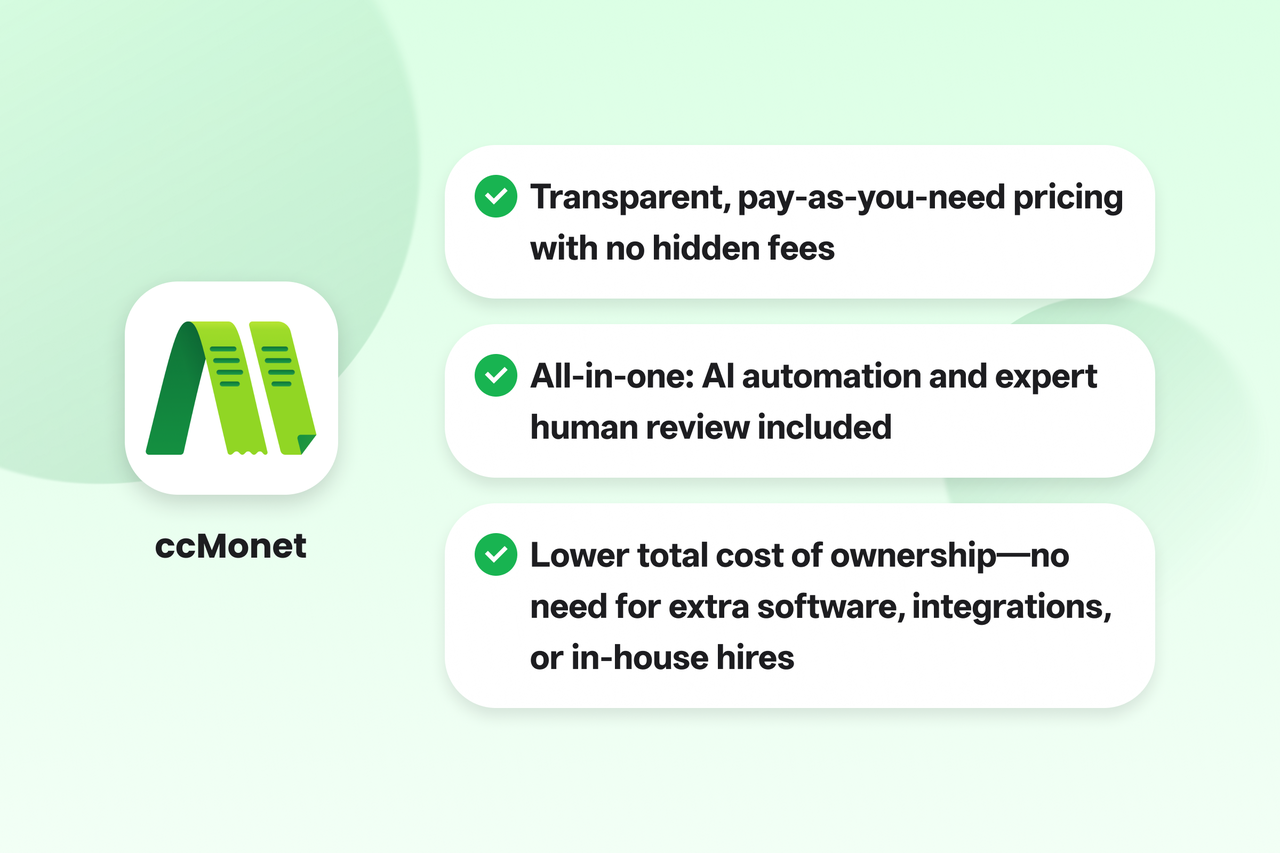

ccMonet:

Transparent, pay-as-you-need pricing

All-in-one: AI automation and expert human review included

No need to buy extra software, add-ons, or hire extra staff

Lower total cost of ownership for SMEs wanting real accounting outcomes

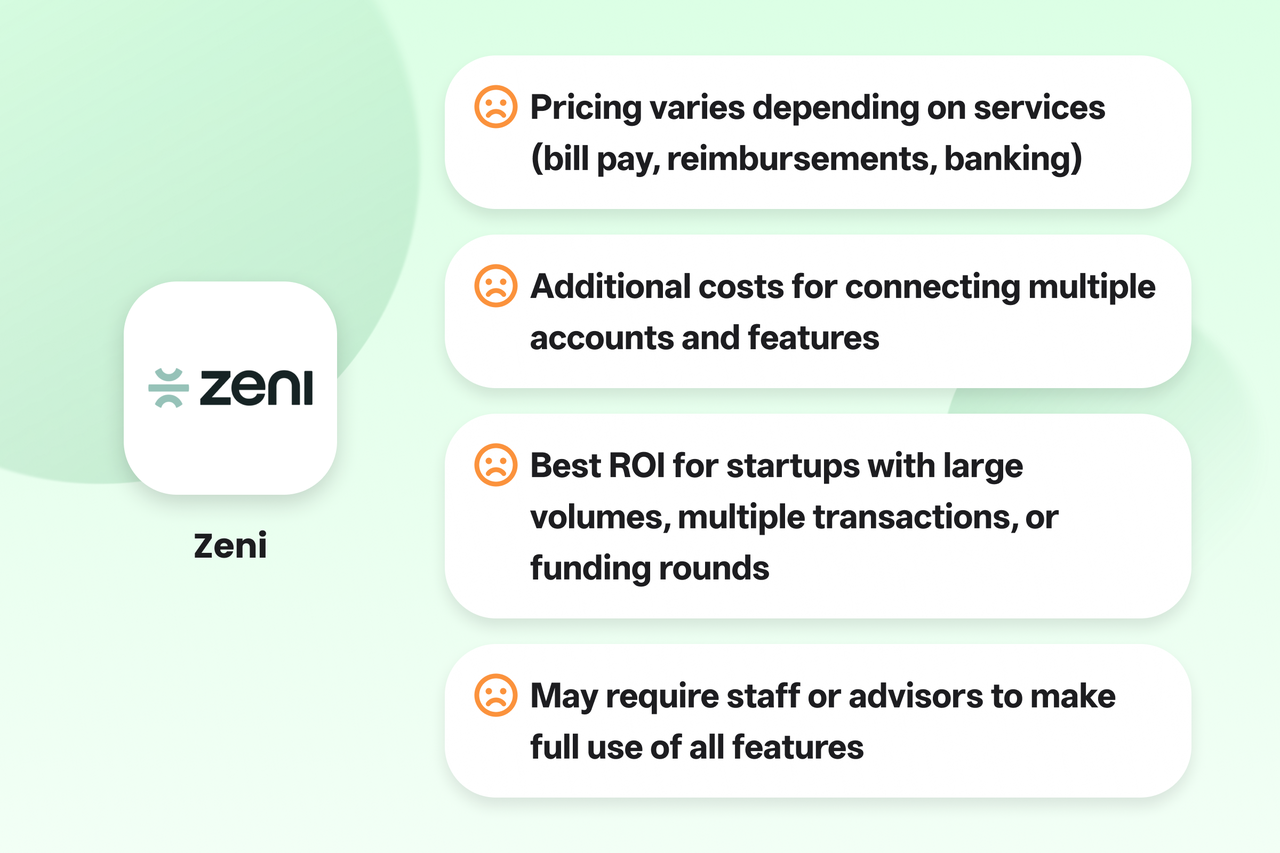

Zeni AI:

Pricing varies depending on services (bill pay, reimbursements, banking)

Additional costs for connecting multiple accounts and features

Best ROI for startups with large volumes, multiple transactions, or funding rounds

May require staff or advisors to make full use of all features

This is crucial for Singapore small business accounting. Zeni AI’s powerful suite is compelling but can cost more if you don’t use all its features. ccMonet’s pricing is fully transparent and all-inclusive, making it easy for SMEs to budget confidently knowing their accounts will be fully compliant and ready for tax season.

ccMonet

AI-driven receipt capture, reconciliation, and expense claims

Automatic, real-time reporting

Certified accountant review for accuracy

Real expert support to solve the SME pain point: “I don’t know what to do, and there’s no one to ask”

Zeni AI

AI automates categorisation, bill pay, reimbursements, and banking

Central dashboard consolidates accounts and spending

Advanced reports require financial understanding to interpret

Designed for teams managing their own integrated financial operations

For many SME owners, the biggest cost isn’t money—it’s time. They don’t want to spend evenings managing payments or checking cash flow. ccMonet’s approach genuinely saves more time every month, letting owners focus on customers, staff, and growing the business.

When you add it all up, Zeni AI is a powerful platform—but one you need to set up, connect, and actively manage. It’s great for startups, funded businesses, or companies with dedicated finance staff. ccMonet is different. It’s Financial Management as a Service.

Complete peace of mind with no accounting experience required

Snap-and-go simplicity for staff

Smart AI plus expert human review for reliable, compliant results

Transparent, all-inclusive pricing with no hidden costs

Support from real accountants who know your business If you’re ready to transform your business finances without the stress, ccMonet delivers Simple. Smart. Reliable. accounting—designed specifically for Singapore SMEs who want to focus on growth, not paperwork.