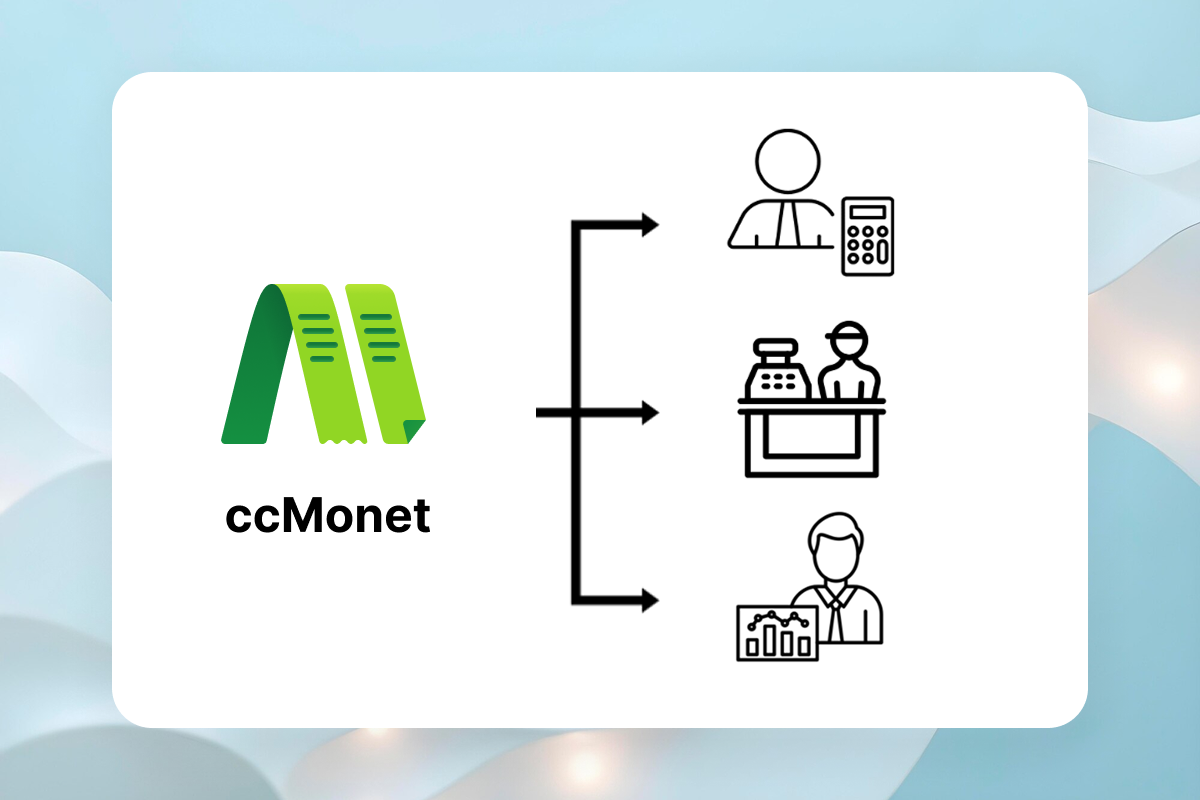

In traditional businesses, accounting, cashiering, and financial analysis are often handled by different people—not because the processes are too complex, but because they each serve two of the business owner's top concerns:

💰 A sense of financial security: someone to record transactions, someone to manage cash, and someone to cross-check the numbers.

📊 Strategic financial insight: someone dedicated to generating reports and analysis so the owner can make informed decisions.

This division of roles ensures both security and transparency through mutual checks and balances.

But in the era of AI, ccMonet addresses these two core needs in a new way:

A dual mechanism of AI automation + expert review ensures data security, regulatory compliance, and error control;

Real-time dashboards + smart Q&A + visualized reports make everything instantly understandable and actionable for business owners;

Full traceability + anomaly alerts provide even more trust than traditional “black-box” decision-making.

So while ccMonet does the work of three people, it's not just about reducing manpower—it's about rebuilding trust: It allows business owners to save time and money while still enjoying the same sense of security and control as with three specialized professionals.

ccMonet is your AI Accountant + AI Cashier + AI Financial Analyst. It’s not a toolbox, nor a platform—it’s an intelligent financial Agent that continuously learns, runs automatically, and delivers results for you, taking over what used to require three separate roles.

When you activate ccMonet, it’s like hiring a full-time online financial assistant—only more powerful:

No matter whether the employee uploads paper receipts, photos, or PDFs, ccMonet can:

Automatically recognize currencies, languages, and handwritten text

Intelligently categorize: by product type, supplier, or project

Automatically log into the ledger—no Excel, no financial background needed

Employees can take a photo of the invoice, and the system auto-matches it and handles reimbursement approval

In the past, cashiers manually checked bank statements and transfers—slow and error-prone. To ease your burden, ccMonet can do the following:

Automated bank reconciliation: after user uploads data, it reconciles with bank statements

Smart matching: matches transactions by date, amount, and description

Intelligent discrepancy detection: identifies duplicate entries, unmatched transactions, and amount inconsistencies

Real-time cash flow charts: owners can check whenever they want, and instantly understand what they see

The ccMonet dashboard can automatically generate:

Profit & cash flow trends: P&L, cash flow, and balance sheets—all viewable anytime, no need to wait for month-end closing

Anomaly alerts: AI flags abnormal expenses, cash volatility, or sudden price hikes to help you respond early

Multi-dimensional views: break down cost and revenue by project, location, or time period; industry templates auto-adapt

Hi Monet Q&A Assistant: Ask directly—“How much did logistics cost last month?” or “Can I afford to hire someone?”—AI replies in seconds with charts and data

Custom report builder: Owners, shareholders, and accountants focus on different priorities? You define the dimensions of the report

Business owners no longer need Excel + an accountant + a consulting team just to know, “Did I make money this month?”

You don’t need to understand accounting—you can still stay professional and compliant.

In a domain as sensitive as money, earning a business owner’s trust is never just a slogan. We believe: a truly trustworthy AI financial system must be built on three structural pillars — Security, Transparency, and Communication.

ccMonet uses bank-grade encryption, strict access control, and regulatory compliance standards to ensure data security, traceable operations, and stable system performance. Just as businesses trust banks with custody, ccMonet provides a foundational sense of trust and security.

AI auto-categorizes? AI offers advice? AI builds reports? — If users can’t understand it, trace it, or ask about it, it becomes a “black box” they’ll never trust. ccMonet adheres to “explainable AI” and delivers:

Every piece of data is reviewed by both AI classification + human expert

Every process is traceable, with immediate alerts on abnormal changes

Every report is source-explained — not a “black box,” but askable, verifiable, and auditable

We also introduced a “human-in-the-loop” mechanism — every critical point is reviewed by a person or can be accessed by an expert, reassuring users:It’s not AI that makes final decisions, but AI recognition combined with human oversight.

No matter how powerful a system is, if it’s poorly communicated, it won’t be trusted. We not only showcase functionality, but also clearly explain:

How is data used? Encrypted and stored, visible only to authorized users, with full traceability

What are AI’s boundaries? We clearly indicate which parts are handled by AI, and which require human review

What if I have a question? You can always reach real financial experts — we guarantee fast responses and clear answers

These may seem like “non-product” messages, but they’re the real reason users feel confident to trust and adopt us.

Trust is shifting — from manual oversight to system credibility.With technology + expertise, ccMonet builds the next-generation foundation of financial trust for businesses.

Before: You needed an accountant, a cashier, and a consultant just to keep your company’s finances running.Now: One ccMonet + a professional support team helps you automatically manage your books, control cash flow, track profits, and stay compliant — giving you peace of mind and clarity.

Spend your time on strategy — leave the finances to ccMonet.

More efficient. More reassuring.